Property Taxes and Fees in Dubai: What Buyers Should Know

Dubai has long been a magnet for property investors, expatriates, and luxury home-buyers. When it comes to property tax Dubai obligations, a favourable cost structure is its one of the biggest attractions. But while you may avoid some of the burdens common elsewhere, there are still Dubai property fees, Dubai real estate costs, Dubai property registration fees, property transfer fees Dubai and associated charges you need to budget for. Here’s a full guide to what you should expect, how much it all typically costs, and how to avoid surprises.

No Traditional Property Tax but Other Costs Apply

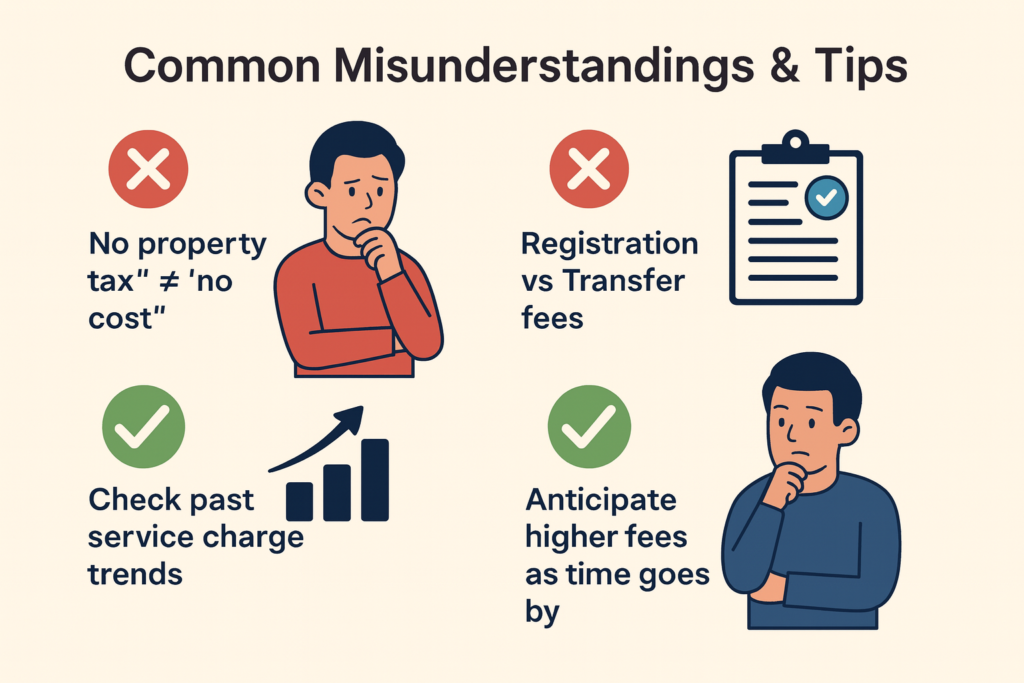

First, it’s crucial to clear up a common misconception: property tax Dubai in the traditional sense (annual taxes on property value, income tax on rent, or capital gains tax on sale) do not apply. Dubai does not levy income tax for rental income nor capital gains tax when you sell a property.

That said, there are various fees and levies connected with buying, owning, and transferring properties—these form the bulk of what buyers need to anticipate in Dubai real estate costs. Unlike many countries, there is no annual property tax in Dubai on residential or commercial ownership.

Key Dubai Property Fees & Transfer Costs

Step-by-Step: How These Costs Add Up

Frequently Asked Questions

CONCLUSION

Low Property tax in Dubai attracts uniquely to buy property. You’ll avoid annual property tax, capital gains tax, and income tax on property income but you’ll still face Dubai property fees and property transfer fees Dubai, property registration fees Dubai, maintenance costs, VAT in certain situations, and agency / conveyance fees. To avoid shocks, build a full cost plan into your investment or purchase from the start with shubh Labh Realtors.

At Shubh Labh Realtors, we guide our clients through all these costs and fees with full transparency, ensuring every Dubai real estate cost is clearly explained and planned. We also help you budget properly, negotiate where possible, and complete all legal formalities smoothly.

With Shubh Labh Realtors Your investment is safe, your purchase is clear, and your peace of mind is guaranteed.

“Shubh Labh Realtors: Turning clarity into your corner-stone in Dubai property investments.”